How much should I price my shares at? So, I've got a great question in front of my YouTube viewers. Love you guys! Hosting to write in, to say big video Evan. I'm learning so much from you, thank you for that. Also, please explain how shares are created in terms of initial value and the part left for future investors. How much should the initial price be? Is it good to have a lower/higher price? Do I need an attorney from the beginning? These are all great questions, especially if you're looking at bringing on investors in your business when you're first starting your company. If it's a sole proprietorship, then there are no shares. If you are forming a company, then you have to create shares in your business. How many shares and what the initial price is doesn't really matter. It's more about the percentage. So, if you're the only owner in the corporation, you own a hundred percent of the shares. Whether it's a hundred shares, a thousand shares, or 10,000 shares, it doesn't make a difference. You own a hundred percent. What makes a difference is the percentage. The initial value also doesn't matter at the start. The difference in value that really makes an important impact is what you sell it at. So, if you're going to bring an investor on board at some point with your business, it doesn't matter what you initially priced the share at. If it was a dollar valuation at the start, that's fine. It doesn't mean you can't sell that same share for a hundred thousand dollars later. The pricing doesn't matter. Should you involve a lawyer from the beginning? Yeah, just like it's good to have an accountant from the beginning. I know it's expensive and there are ways around it....

Award-winning PDF software

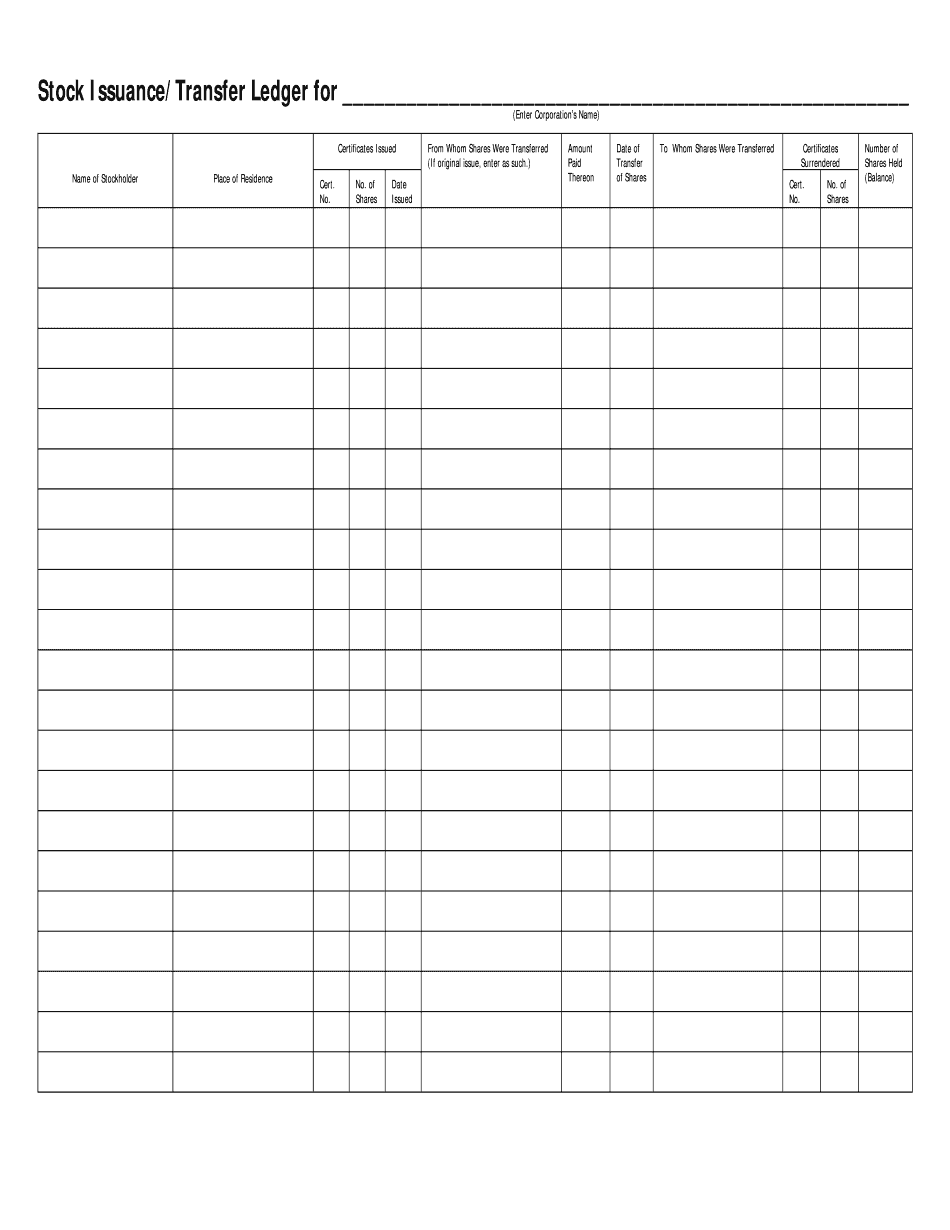

Corporate Stock Ledger Form: What You Should Know

CBP Form 178 (04/03) CBP Form 178 (04/03). Overflight: Car X. Overflight Location: CBP. Name of Aircraft: Type: Model (Air Type) (Aircraft #). CBP Form 178 (03/03) CBP Form 178 (03/03). Overflight: CBP. Overflight Location: CBP. Name of Aircraft: Type: Model (Air Type) (Cockpit). CBP Form 178 (03/03) CBP Form 178 (03/03). Overflight: CAR #, Overhead: CAR#, Arrival: Date. Inspection Date: ☐ Yes ☐ No (See attached) CBP Form 178 (03/03) CBP Form 178 (03/03). Overflight: CAR#, Overflight Date: CAR#1, Arrival Date: CAR#2, Type of Claim: CBT Form 337 (Nonproliferation, Anti-Terrorism, Demilitarization, Civilian Aircraft Destruction, and Related Measures). CBP Form 178 (03/03) CBP Form 178 (03/03). Overflight: CAR#, Overflight Date: CAR#1, Arrival Date: CAR#3, Type of Claim: CBT Form 337 (Nonproliferation, Anti-Terrorism, Demilitarization, Civilian Aircraft Destruction, and Related Measures). CBP Form 178 (03/03) Inspector's Name: Badge #, PAES Report #. Compliance Exam: ☐ Yes ☐ No, Results: CAR#2, Car X: CAR#1, CAIN#: ☐ Yes ☐ No. CBP Form 188 (08/16) Notice of Release of CBP Airborne Patrol System (APPS) Notice of Release of Airborne Patrol System (APPS) from Customs/Border Protection, Pursuant to 21 U.S.C. § 2383(f).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Stock Transfer Ledger, steer clear of blunders along with furnish it in a timely manner:

How to complete any Stock Transfer Ledger online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Stock Transfer Ledger by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Stock Transfer Ledger from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Corporate Stock Ledger