Let's look at how stock cards are completed using FIFO. For example, JB Hi-Fi has a Sony TV inventory item which it sells to customers. How would it use a stock card and FIFO to do that? So let's say on the first of July, the opening balance of stock was 5 units, and they were valued at $180 each. We start with the details, which is the date (first of July), the reference (balance), and then we go all the way over to the balance column. We state that the opening balance was 5 units of $180, for a total of $900. The next transaction occurred on July the 2nd, where 10 units were purchased on credit, invoice 843, for $190 each, plus GST. So, we record the date (2nd of July), the invoice (843), and the units purchased (10) at $190 each, for a total of $1,900. Note that we only use the cost prices in the stock card and don't consider the GST. Moving to the balance column, we list things in FIFO order. We rewrite the previous day's total of 5 units of $180 and, underneath that, we write the incoming 10 units at $190. The next day, a customer comes in and we sell 2 units for cash, at $300 each, plus GST. However, since the stock card only records the cost price, we don't need to include the $300 in the stock card. We assume first-in, first-out, so the first units in the stock (the $180 units) must be sold. We record 2 units at $180, totaling $360, in the out column. We now have 3 units of stock remaining at $180, totaling $540. Next, we have a transaction where we sell 5 units on invoice "What I Want," sold for $280 each, plus GST. Again, the...

Award-winning PDF software

How to maintain Stock Ledger Form: What You Should Know

You have the option to select the fully developed claim program as your method to complete this application. However, we strongly recommend you to first choose the fully developed claim The fully developed claim program is a faster process because you can choose the process you want to finish first. It's a process you choose right in your online application. How Does VA Form 21-526EZ Work? The fully developed claim program is faster because you can choose the process you want to finish first. It's a process you choose right in your online application. VA Form 21-526 Part A: Application Claims Process Step 1: Sign in to the VA's website. Click “Apply now” at the top of the page. Step 2: Select the Part A. Step 3: Click next to continue or click “Submit” to finish completing Part B and Part C Step 4: Finish Part D The fully developed claim program is a faster process because you can choose the process you want to finish first. It's a process you choose right in your online application. VA Form 21-526 Part B: Claims Processing Process The fully developed claim program is faster because you can choose the process you want to finish first. It's a process you choose right in your online application. Step 5: Click next to continue or click “Submit” to finish processing your Part C application VA Form 21-526 Part C: Claim Payments Process The fully developed claim program is faster because you can choose the process you want to finish first. It's a process you choose right in your online application. VA Form 21-526 Part D: Payment of Claims Process VA Form 21-526 Part D: Claim Payments Process: Step 1: Download the Part D application. Click Start and download Part D to your computer's hard disk. Note: You must have your e-mail address, mailing address, and ZIP code before logging in to the Form 21-526 Part D. Click “Start” or click “Download”. Step 2: Once you start your Part D application, you can use the “Continue” button if you need to resubmit, and the “Failed” button if you are unable to continue your application. Once you start your Part D application, you can use the “Continue” button if you need to resubmit, and the “Failed” button if you are unable to continue your application.

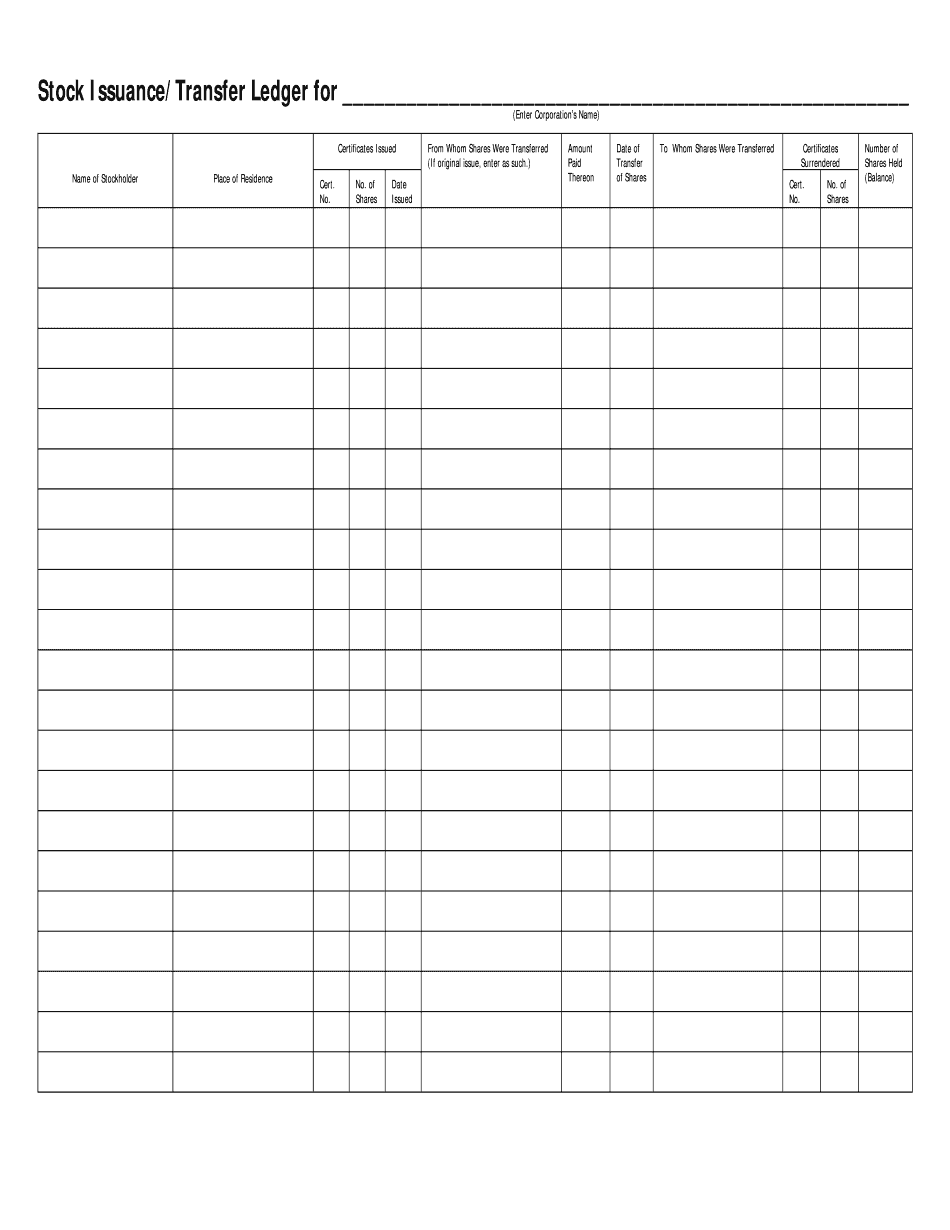

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Stock Transfer Ledger, steer clear of blunders along with furnish it in a timely manner:

How to complete any Stock Transfer Ledger online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Stock Transfer Ledger by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Stock Transfer Ledger from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to maintain Stock Ledger